As new capital budgeting projects arise we must estimate – As new capital budgeting projects arise, we must estimate their costs, benefits, and risks to make informed decisions about which projects to approve. This process involves a comprehensive analysis of the potential financial impact of each project, considering factors such as market fluctuations, technological advancements, and regulatory changes.

By carefully evaluating the potential costs and benefits of each project, we can determine which ones are most likely to generate a positive return on investment and contribute to the long-term success of the organization.

Capital Budgeting: A Comprehensive Guide to Project Evaluation

Capital budgeting is a crucial process for businesses to make informed decisions about long-term investments. When new capital budgeting projects arise, it is essential to estimate their costs and benefits accurately to ensure optimal resource allocation.

1. Estimate Project Costs and Benefits

A thorough understanding of the costs and benefits associated with capital budgeting projects is paramount. This involves:

- Breakdown of Costs:A detailed analysis of all expenses related to the project, including initial investment, operating expenses, and maintenance costs.

- Potential Benefits:Identification of the anticipated advantages, such as increased revenue, reduced expenses, or improved efficiency.

- Comparative Table:Creation of a table that presents a comprehensive comparison of the estimated costs and benefits of each project.

2. Identify and Evaluate Risks

Recognizing and assessing potential risks is vital for informed decision-making. This includes:

- Risk Identification:Identifying potential risks associated with each project, such as market fluctuations, technological advancements, or regulatory changes.

- Likelihood and Impact:Assessing the probability and potential impact of each risk.

- Risk Mitigation Strategies:Developing strategies to minimize or manage the identified risks.

3. Determine the Appropriate Discount Rate

The discount rate plays a significant role in capital budgeting analysis. It involves:

- Concept of Discount Rate:Explanation of the concept of a discount rate and its importance in capital budgeting.

- Influencing Factors:Discussion of factors that influence the choice of discount rate, such as risk-free rate, project risk level, and cost of capital.

- Recommendation:Provision of a recommendation for the appropriate discount rate to use for the projects.

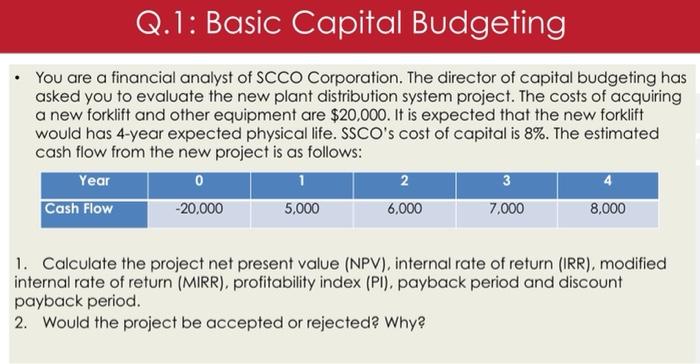

4. Calculate the Net Present Value (NPV)

NPV is a critical tool for evaluating capital budgeting projects. It involves:

- Concept of NPV:Explanation of the concept of NPV and its use in capital budgeting.

- Calculation:Demonstration of how to calculate the NPV of each project.

- Advantages and Limitations:Discussion of the advantages and limitations of using NPV as a capital budgeting tool.

5. Make a Recommendation: As New Capital Budgeting Projects Arise We Must Estimate

Based on the NPV analysis, it is essential to make informed recommendations.

- Project Approval/Rejection:Recommendation on which projects should be approved and which should be rejected.

- Justification:Provision of a justification for the recommendation, considering the costs, benefits, risks, and discount rate.

- Summary and Conclusion:Summarization of the key findings of the analysis and provision of a clear conclusion.

FAQ Corner

What is capital budgeting?

Capital budgeting is the process of evaluating and selecting long-term investment projects that are expected to generate a positive return on investment.

What are the key factors to consider when evaluating capital budgeting projects?

The key factors to consider when evaluating capital budgeting projects include the project’s costs, benefits, risks, and the appropriate discount rate.

What is the net present value (NPV) and how is it used in capital budgeting?

The net present value (NPV) is the difference between the present value of the project’s cash inflows and the present value of its cash outflows. It is used to determine the profitability of a project and is a key factor in capital budgeting decisions.